Cloud Mining – How to Start Earn Money Today?

Cloud Mining recently has gained increasing trending popularity for today. Such services, like HashFlare, Genesis Mining are in great demand. More and more people are starting to mine crypto currencies everyday, striving to increase their assets and cloud mining is like silver bullet, cause you don’t need think about where to buy equipment and what modification it has to be, about the place where you shoud place it for mining, about electricity and one expences, etc. So, cloud mining solve at once many problems for their users and start earning money from the 1st minutes of work.

In this article we offer short review of two the most popular clod mining services: HashFlare and Genesis Mining. Also, we offer the latest and valid promo code for Bitcoin, Ethereum, Zcash, Laicoin and Dash cloud mining on HashFlare.io platform. This codes should be valid till the end of December 2017.

How to use HashFlare promo codes

If you are looking for some

discounts to buy services of HashFlare cloud mining, use promo code and find more info below. For

usuing promo code you need to do next steps:

If you are looking for some

discounts to buy services of HashFlare cloud mining, use promo code and find more info below. For

usuing promo code you need to do next steps:

- Login or Register in HashFlare.io – you need obviously confirm last with email;

- After you should go to your profile, whish will be situated at the right top of your screen;

- To start mining you need purchase at least one hashrate, but it is better to buy at least two contracts, for example, the 1st one for Bitcoin mining

- If you don’t have hashrate, than you need to buy: SHA-256, X11, Scrypt, EQUIHASH or ETHASH one

- Choose the type and amount of hashrate you want to buy and click “Proceed”

- Select the payment method for purchasing hashrate and confirm one

- Than you should go to menu item “Voucher”, it is on the left sidebar of your account and enter your promo code, than click “Redeem”.

Previous promo codes for HashFlare

We also offer all prior promo codes which were valid during previous months. We think that they can somehow be valid, notwithstanding the fact that official promo codes` validity has already expired. Some of them do still work.

For instance, you can try to use such old codes and promo as:

- Coupon code: 10% discount on any HashFlare mining contract: you can ask one in HashFlare support

- 10 GHS for $1,5 till the 10th of January 2018, go to the Hashflare.io

- 10% commission for attracting new customers, it is free for HashFlare web site, no code needed

So, on CloudMiningBlog.com we are gathering best coupons, deals which everyone can use for making one’s profit better, Usually, the best discounts are on Cyber Monday and Black Friday Days.

HashFlare

HashFlare

Hashflare is a division of the well-known company HashCoins, the manufacturer of ASIC equipment for mining. Used to run a device of its own production.

And now you have seven days to buy any hashrate you like at profitable prices*:

- EQUIHASH: $1.20

- SHA-256: $1.40

- ETHASH: $1.65

- X11: $0.65

- Scrypt: $5.6

*Note: All DASH mining contracts can be removed from sale by the end of the discount period. It will not affect any of already purchased contracts. Also terms of payments for today can be changed already.

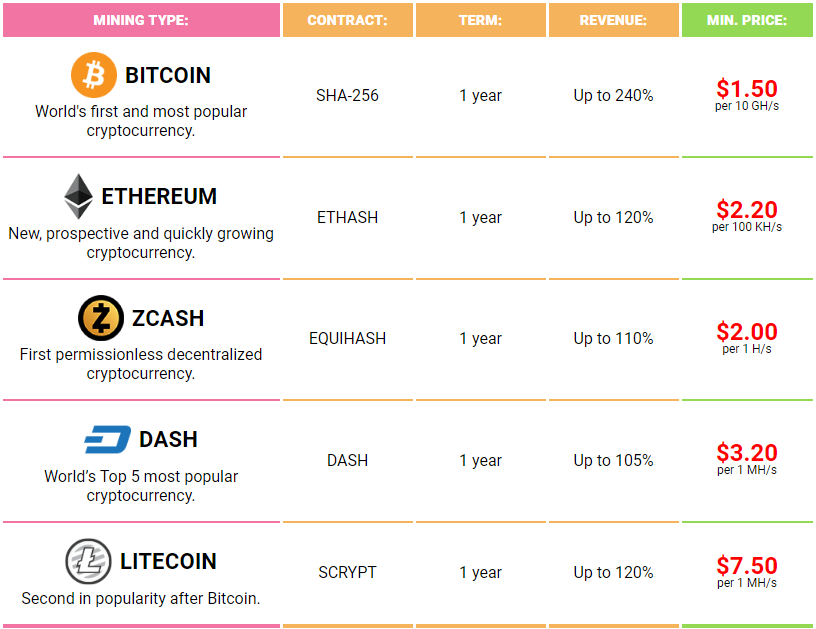

Genesis Mining

Genesis Mining was founded in late 2013 and is based on a variety of algorithms. Now there is a promotional code for a 3% discount – you can ask one in Genesis Mining Support. It is the main competitor of HashFlare and one platform is also very popular among miners, so if you want to compare them, register in the system and try it’s cloud mining on practice, pursching one of the hashrate contracts.

- Cost – at the moment: BTC 35.8$ for 200 GH / s (perpetually); ETH $ 29.99 per 1 MH / s (2 years).

- Reliability of service – the service has been working for a long time and has a large number of customers.

- Real power – the service has real data centers in Iceland.

- Convenience – the service has realy good interface

Summary

Summary

So, you shoud know that HashFlare.io & Genesis-Mining.com turned into the best cloud mining services for Bitcoin, ZCASH, Ethereum, Sash, Litecoin.

If you have not tried mining before, then it’s time, for this you do not need to buy equipment, rent, pay for electricity, buy space for computers, monitor the work of PCs, etc. Cloud mining allows you to save time and money, and for to start, you need only to go through only 3 steps:

- register in both services: HashFlare ot Genesis Mining, just to compare both and choose one you’d like mor;

- choose appropriate contract: with capacities, period of time, cryptocurrency you want to mine

- make payments for equipment capacity: you can do it with USD, EUR, etc or cryptocurrency

- enter your promo code in the item “Voucher” and confirm.

If you hasitate, just use tips lower to chose cloud mining service is better for you!

What are the requirements for an ideal service?

Pay attention in cloud mining for next:

- Low cost – the cost of purchasing capacity is very important, since it strongly affects the rate of return on investment.

- Reliability of service – the most important requirement for the service. There are many fictitious services that disappear with your money.

- Real Equipment – the service can provide a guarantee of payment of money only if it has its own equipment for mining.

- Convenience – various additional options that increase profits and increase the ease of use of the service.

How does cloud mining work?

- Step 1: Register in the service – You register an account in the selected cloud-mining service and get to your personal cabinet.

- Step 2: Purchase of capacities – You buy a certain number of capacities for a regular currency or a crypto currency. Purchased power begins to make a profit immediately.

- Step 3: Accumulation – Every day, a crypto currency is credited to your balance sheet. You can reinvest it by investing in the purchase of additional capacity, or simply to accumulate.

- Step 4: Withdraw Funds – When a certain amount accumulates in the account, you can withdraw it to your crypto-purse.

- Step 5: Exchange for Money – You exchange the derived crypto currency for real money through one of the exchange offices.

Estimation of profitability

To estimate the profit from investing in cloud-based mining, we will calculate how much we can get for 1 year with the initial investment of $1000. The assessment will be conducted for the two most popular currencies at the moment: Bitcoin and Ethereum.

Bitcoin

|

Investment

|

Cost of capacity

|

Maintenance fee

|

Acquired capacity

|

Profit/Day*

|

Profit per year*

|

Profit**

|

|

|---|---|---|---|---|---|---|---|

|

|

1000$ |

1.50$For 10 GH/s |

0.0035$For 10 GH/s |

6667 GH/s |

1.02 mBTC |

0.37 BTC |

4838$ |

|

|

1000$ |

35.80$For 200 GH/s |

0.00028$For 1 GH/s |

5587 GH/s |

0.90 mBTC |

0.33 BTC |

4263$ |

* The approximate calculation of income as of December 2017 is shown without

taking into account the increase in complexity.

** The profit is based on the current

exchange rate of Bitcoin, without taking into account its growth.

*** At the moment, the

sale of Bitcoin’s capacities has been suspended due to the expansion.

Ethereum

|

Investment

|

Cost of capacity

|

Maintenance fee

|

Acquired capacity

|

Profit/Day*

|

Profit per year*

|

Profit**

|

|

|---|---|---|---|---|---|---|---|

|

|

1000$ |

2.2$За 100 KH/s |

45 MH/s |

7,43 MH/s |

8.59 mETH |

3.14 ETH |

4391.35$ |

|

|

1000$ |

29.99$За 1 MH/s |

33 MH/s |

33 MH/s |

6.3 mETH |

2.3 ETH |

3221.4$ |

* The approximate calculation of income of December 2017 is shown without taking into account

the increase in complexity.

** The profit is based on the current Ethereum rate, without

taking into account its growth.

*** At the moment, the sale of Ethereum’s capacity

has been suspended due to the expansion.

Please be aware that some info, promo codes can be our of date or broken! All info please check on official web site of the services.

Reviews about cloud mining service

Reviews about the services were taken from open, reliable sources.

- Computing power is provided for a period of 1 year. The HashFlare team predicts profitability even in view of the increasing complexity of the production of crypto currency. Another great thing in HashFlare, it’s reinvestment, when the money earned can be immediately put into circulation, it is very well thought out

- HashFlare pays constantly for a very long time, which makes this cloud-mining service not replace for miners. Investments paid off already with interest, for which many thanks)

- Genesis Mining is very good, especially their support works very well, Sun clearly. Altkoins are the most profitable, I highly recommend to try this service.

- Genesis is very cool and pricey. If you try, you can find a discount or a promo code even. By the way, it is very convenient to analyze expenses and incomes.

FAQ

- What is the benefit to the services themselves? – One of the most common questions: “What is the benefit to the services themselves to provide capacity for mining, if you can mine them yourself?”. The point is that the time of return of investment in mining is about 8-12 months. By selling the same part of capacity, services can significantly reduce the time of return of investment for themselves and constantly purchase new capacities.

- Is it possible to trust such services? – Of the hundreds of cloud-based services, three were chosen, which really inspire confidence, primarily due to the availability of their own data centers with mining equipment.

- Why is cloud mining better than usual? – In the case of buying ordinary miners, a number of problems must be solved: 1. Accommodation. Miners are quite noisy devices and placing them in living quarters will bring a number of inconveniences. 2. Cooling. In connection with the round-the-clock work, the miners need a good cooling, due to which the service life is extended. 3. Nutrition. One mining farm consumes about 1.4 kWh, which requires a high quality wiring in the room. When installing more than 3 miners, the question arises of carrying out a separate line, since standard household lines are not designed for a power higher than 4-6 kW. 4. Maintenance. Miners periodically hang, they need to be tuned to the maximum speed and give them a certain amount of time. 5. Breakage. Most of the mining farms are not covered by the guarantee, therefore, the breakdown of the farm may lead to collapse. Cloud mining deprives you of all these inconveniences.

- How to get your money? – You can deduce the received profit on a purse of one of криптовалют, and then to change on a stock exchange on real currency.

- What equipment does the services use? – Often used special devices for mining – ASIC. In addition to them, for mining altcoyinov, usually set miners on the basis of video cards.

* Important note: you need to understand that some promo codes/coupons could be ended not only by date, but also finished by quantity, so hurry up, cause some of them may already be invalid.